Guess Whose Back, Back Again

Firstly, welcome (if this is the first time you're getting an Empire Builder's email) or welcome back!

You are getting this newsletter because you either recently had signed up for my newsletter or you had signed up for it at some point in the past.

It's been a moment since I last sent out an newsletter, so to help refresh your memory, allow me to reintroduce myself:

Who am I

Hello! I am Josh, a Tax & M&A attorney that helps entreprenuers buy, grow and sell their main street business through empowering and effective education.

My practice is built around one simple belief: your business should work as hard for you as you’ve worked to build it. Whether structuring a tax-efficient exit, navigating an acquisition, or setting up an entity that minimizes exposure and maximizes opportunity, my focus is always on helping owners think and operate like investors.

Over the past few months, I’ve been quietly retooling my practice and content to better serve business owners like you. You’ll start seeing more practical insights on M&A strategy, tax structuring, deal execution, and wealth-building through business ownership. These are the same conversations I have every day with clients across the country. My goal is simple: to give you the tools, frameworks, and clarity to build something lasting and to know exactly how to protect it when opportunity or exit comes knocking.

Changes and Feedback:

While it doesn't need to be said, I am in the process of moving to a new newsletter provider.

I am hoping this new system is a little smoother in providing a great experience for you as a reader.

That said, I fully expect that this transition will not go without some hiccups along the way. So first and foremost please be patient as I work to make this transition. Further, please give me your feedback! What is working and what isn't working?

For example, if you're having trouble unsubscribing (while I'll be sad to see you go, I definitely understand) let me know and I'll be sure to get this sorted out ASAP.

Coming Up: The Three-Part Series on Entity Selection

Over the next three issues, we’ll unpack one of the most critical, and often misunderstood, decisions every business owner faces: choosing the right legal entity.

When new business owners and their advisors talk about starting a new company, they typically default to a LLC or Limited Liability Company. But that's not always the case.

There are, in fact, two commonly formed entity types and three different tax classifications that the majority of entreprenuers will fit into. Understanding the differences between each of them can be the key to having a ton of success or struggling to stay afloat.

Over the next three issues, I'll work to break down the key differences between LLCs, Corporations and their tax classifications, including disregarded entities, partnerships, S corporations and C corporations.

But lets start with a little background first:

Entity Selection for Legal Purposes

When making a decision around choosing the right entity, there are generally two different decisions to be made.

The first is going to be how the entity is form for legal purposes. Think of this in the context of state laws. Every state will have its own set of rules around the rights, responsibilities and requirements to maintain a specific type of legal entity.

In the context of entity formation, this usually breaks down into one of three categories (although there are a number of different legal entity types you can form under state law!):

- Limited Liability Companies

- Corporations

- Partnerships

Most states will have seperate statutes for each of these three entity types that will give entity the guidelines that it must follow to be compliant with state law. To remain compliant under state law, legal entities must file required annual or biennial reports, pay franchise or business privilege taxes, and maintain a registered agent with a current address. They must also keep accurate internal records, such as governing documents, ownership ledgers, and meeting minutes, and use their proper legal or registered trade name in all business dealings. Corporations and LLCs face additional formalities, including documenting key decisions, maintaining updated ownership information, and staying current on all state, federal, and local licensing and tax obligations.

Entity Selection for Tax Purposes

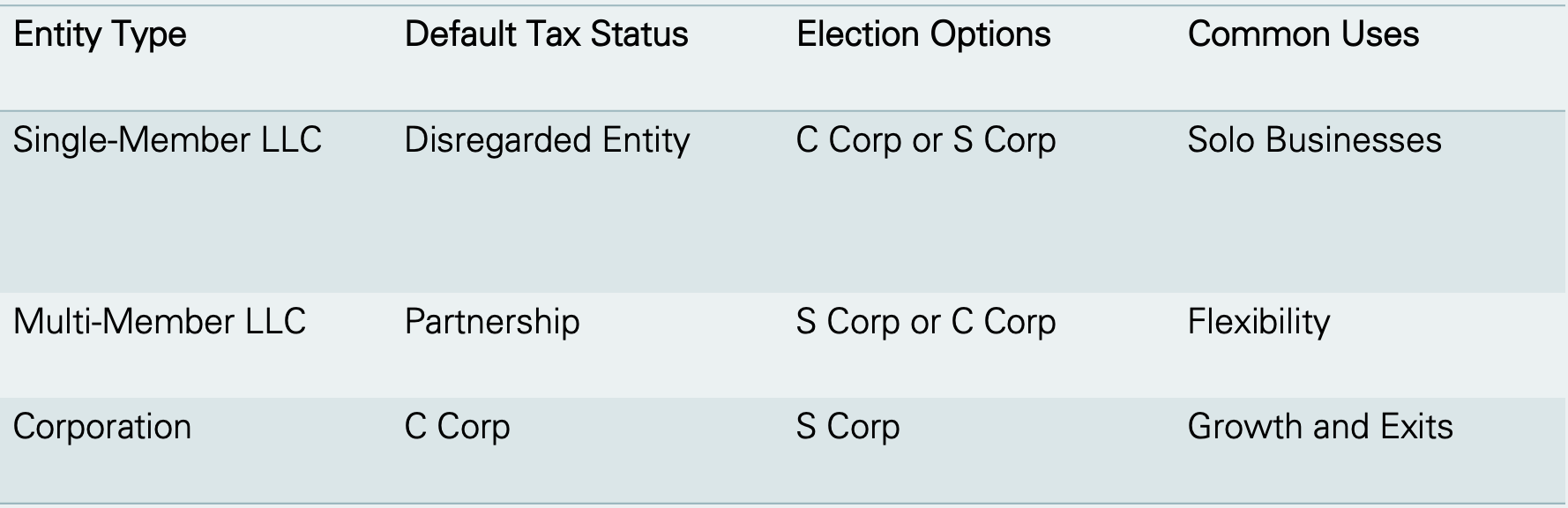

Once the legal entity type has been decided on, the next part of the analysis will be how the entity will be taxed for both Federal and State purposes. Generally, all entities will have a default tax classification, they break down as follows:

Just because an entity is formed and has a default tax classification doesn't mean that is the tax classification that needs to stick. Certain entity types, such as LLCs and Corporations can choose to be taxed under a different set of rules under the tax code.

Closing Thoughts

In the coming weeks we will explore the the various nuances of each of the entity types that are crucial to think through when forming a new business.

Failing to take a time to think this critical decision can result with you leaving valuable tax dollars on the table and result in headaches down the road.